What is the Micro Pension Plan?

The Micro Pension Scheme (MPS)is designed to help traders, artisans, professionals and other self employed people who do not qualify for the Contributory pension scheme (CPS)*, save conveniently for retirement. The National Pension Commission operating under the Pension Reform Act 2014 already has the Contributory Pension Scheme running actively for individuals in corporate organizations with at least three (3) employees to help them save enough for retirement. These persons have a unique Personal Identification Number (PIN) with which they are identified.

Now, this opportunity has been extended to help low, middle and high income earners in the informal sector save easily by providing a regular flow of income in retirement. This sector constitutes the larger percentage of Nigeria’s working population and are perceived to generally have irregular stream of income.

Mode of Withdrawal

Every contribution received is split into two portions: The Contingent portion (40%) and the Retirement Benefit portion (60%). They can be accessed as stated below:

Contingent Withdrawal

The Contingent portion of the contribution can be accessed totally or partially, only after the initial remittance has stayed in the RSA for at least 3 months. Thereafter, subsequent withdrawals can be accessed once in a week. Contributors have the option of converting their contingent portion to retirement benefit portion totally or partially at the end of each year.

Retirement benefit Withdrawal

Contributors upon retirement and having attained the mandatory age of 50 years can access their retirement benefits in line with the Regulation for Administration of Retirement and Terminal benefits. This is also applicable to contributors that retired on medical grounds.

Why choose us?

15 years + in the pensions industry

Our track record spans over a decade of dedicated expert pension fund management.

Excellent Customer Service

We value our customers and treat them like the royalty they are. Our commitment remains to provide excellent customer services to each one of our clients to ensure that their tomorrow looks good.

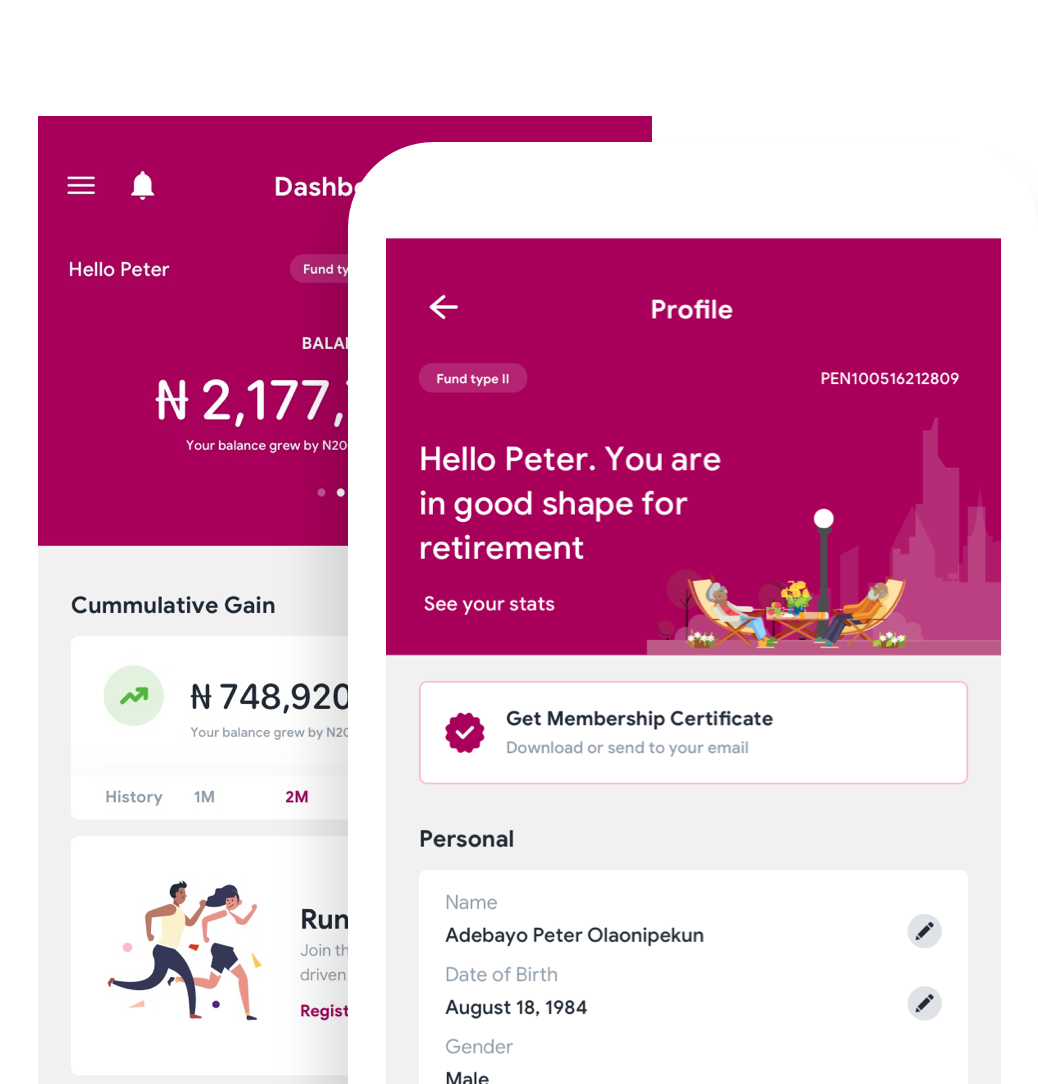

100% Digital

Our 100% digital touchpoints makes it easy for our clients to gain access to their accounts and us at the push of a button or the swipe of a mobile phone.

Ways to pay into your micro pensions account

*597#

Don’t have internet access? Use our USSD service to make payments conveniently. Just dial *597# and follow the prompts.

Instant Pay

Visit pay.armpension.com from the convenience of your home to make payments into your micro pensions accounts

Zenith Bank

Walk into any Zenith Bank branch nationwide to make payments into your micro pensions account

Jane Chat Bot

Got a Facebook account? Use Jane to help you make payments directly from your bank account to your RSA. Chat Here