Our objective is to ensure that all our clients, including beneficiaries of deceased/missing persons, have access to their benefits as and when due in compliance with the Pension Reform Act 2014, as well as the rules and regulations guiding the Administration of Retirement and Terminal Benefits issued by the National Pension Commission.

Accessing Benefits on Temporary Loss or Exit from work

An RSA holder who is less than 50 years of age and has not been in any form of paid/gainful employment for a minimum period of four (4) months after formal exit from employment is qualified to apply for 25% of the balance in his/her Retirement Savings Account in line with the Regulations for the Administration of Retirement and Terminal Benefits. This category of withdrawal can be accessed once as long as the RSA holder is less than 50 years of age.

Requirements for Accessing 25% lump sum after four months of unemployment/loss of Job:

- Application letter from the RSA holder

- Birth Certificate or Age Declaration

- Exit letter from the last employer

- Confirmation letter from the last employer.

- Photocopy of a valid form of identification (i.e. Driver’s license, National ID etc.).

- 2 passport photographs of the RSA holder

- A duly completed ARM Pension Retirement Withdrawal Form

Additional Requirements

- NIMC slip/Card (NIN number)

- Appointment/Employment/Confirmation Letter

Accessing Benefits on Voluntary or Mandatory Retirement

An RSA holder can retire upon attaining the age of 50 years old in the Federal Public Service or Private sector organization, and can opt for any of the following benefit options as allowed under the Act or in line with the Regulations for the Administration of Retirement and Terminal Benefits:

- En-bloc Payment – This can be accessed only where the expected monthly pension payable is less than one third of the prevailing minimum wage.

- A lump sum – the amount payable after sufficient provision have been made to procure a programmed withdrawal or an annuity that will produce an amount that should not be less than 50 percent of his/her annual salary as at the date of retirement.

- Programmed Withdrawal – a series of regular payment (monthly or quarterly) based on the retiree’s expected life span (otherwise known as guaranteed pension period).

- Annuity purchased from a licensed Life Insurance Company.

Requirements for Accessing Benefits at Voluntary or Mandatory Retirement

- Official notice of retirement/exit from last employer – original to be sighted

- Appointment Letter – original to be sighted

- Certified true copy of the retirement bond certificate (Public Sector Retiree).

- Confirmation letter from the last employer (Private Sector/Self-funding MDA retirees)

- Last pay-slip not less than three (3) months from the date of retirement (stamped and signed by employer) or any evidence of last annual remuneration. – original to be sighted

- Two passport photographs of the RSA holder.

- Retiree Indemnity Form (deposed to before a Commissioner of oath or Notary Public)

- Birth Certificate/Age Declaration (Private Sector/Self-funding MDA retirees) – original to be sighted

- Photocopy of form of identification (i.e. Driver’s license, National ID etc.)

- A duly completed ARM Retirement Withdrawal Form

- Retirement option Consent Form

Based on retirement option chosen.

- Completed Programmed Withdrawal Agreement for retirees opting to retire on Programmed Withdrawal

- Annuity Provisional Agreement from the Insurance company of choice for retirees opting for annuity.

Additional Requirements

- NIMC slip/Card (NIN number)

- Promotion letter and pay slips indicating grade level and step as at 30th June, Jan 2007, July 2010, Dec 2013, Dec 2016 (Public Sector Retirees only)

- IPPIS No. (MDAS under IPPIS)

- Transfer and acceptance of service (where applicable)

All original documents will be sighted at the time of submission of withdrawal application.

Accessing Benefits on Retirement due to Medical Reasons

An RSA holder who is retired on medical ground i.e. due to total or permanent disability either of mind or body will qualify to access full retirement benefits not considering his/her age and can opt for any or a combination of the following benefit options as allowed under the Act or in line with the Regulations for the Administration of Retirement and Terminal Benefits:

- En-bloc Payment – where RSA balance is less than N550,000.

- A lump sum – the amount payable after sufficient provision have been made to procure a programmed withdrawal or an annuity that will produce an amount that should not be less than 50 percent of his/her annual salary as at the date of retirement.

- Programmed Withdrawal – a series of regular payment (monthly or quarterly) based on retiree’s expected life span (otherwise known as guaranteed pension period).

- Annuity purchased from a licensed Life Insurance Company.

Requirements for Accessing Benefits on Retirement for Medical Reasons

- Certified true copy of a medical certificate issued by a properly constituted Medical Board or a suitably qualified physician;

- Letter of notification of retirement issued by the employer also authenticating the medical certificate

- Last pay-slip not less than three (3) months after retirement (stamped and signed by the employer) or any evidence of last annual remuneration.

- Certified true copy of the retirement bond certificate (Public Sector Retiree).

- Confirmation letter from the last employer (Private Sector/Self-funding MDA retirees)

- A duly completed ARM Retirement Withdrawal Form

- Two passport photographs of RSA holder

- Completed Programmed Withdrawal Agreement and Retiree Indemnity Form (deposed to before a Commissioner for Oaths or a Notary Public)

- Photocopy of form of identification (i.e. Driver’s license, National ID etc.).

- Based on retirement option chosen.

- Completed Programmed Withdrawal Agreement for retirees opting to retire on Programmed Withdrawal

- Annuity Provisional Agreement from the Insurance company of choice for retirees opting for annuity.

Additional Requirements

- NIMC slip/Card (NIN number)

- Promotion letter and pay slips indicating grade level and step as at 30th June, Jan 2007, July 2010, Dec 2013, Dec 2016 (Public Sector Retirees only)

- IPPIS No. (MDAS under IPPIS)

- Transfer and acceptance of service (where applicable)

Accessing Benefits of a Deceased RSA Holder

A Beneficiary under a Will or an Administrator appointed under a Letter of Administration can access the deceased RSA in line with the PRA 2014 or the Regulations for the Administration of Retirement and Terminal Benefits for:

- En-bloc payment of the RSA balance which may also include Accumulated contributions (if any) and Accrued Pension Benefits. Group Life Insurance will be paid in line with Section 8(1) of the PRA 2014.

Requirements for Accessing Benefits of a Deceased RSA Holder

- Letter of Administration or Will admitted to Probate or Court Order.

- Certificate of Death/Cause of Death (Police Report if death is by accident).

- Satisfactory means of identification of the beneficiaries, which may be any of the following: Current Driver’s License, International Traveling Passport, National Identity Card. (Name of beneficiary should be as it is written on the Letter of Administration/Will).

- Letter from a Notary Public attesting to the demise of the RSA holder and confirming the supposed NOK as the legal beneficiary eligible to access the deceased estate with the passport photograph of both the deceased and beneficiary(ies) properly affixed.

- Copy of letter of first appointment. (Public Sector only) (For Nigerian Police – Attestation Letter from Nigerian Police is the only valid letter that will suffice for Appointment Letter).

- Birth Certificate/Declaration of Age of the deceased (Public Sector only).

- Copy of stamped last pay slip including evidence of grade level and step within the year of demise, 30th June 2004, January 2007, June 2010 (Public Sector only).

- Letter of introduction from employer with deceased and NOKs’ passport affixed and stamped (stating DOB, DOFA, DOD, grade level and step as at June 2004, January 2007, June 2010, Year of Demise, Name of NOK) it must be signed by 2 signatories (public sector only).

- Letter of introduction from employer with deceased and NOKs’ passport affixed and stamped introducing the deceased, NOK(s) and accrued rights status (private sector only)

- Two (2) passport photographs of the deceased (PEN/DBA no written behind the passport)

- One (1) Passport photograph of each beneficiary (Name written behind the passport accordingly)

- Bank confirmation of estate account or joint account where they are more than one administrator named in the LOA or beneficiary named in the Will.

- Newspaper Publication/Gazette – as evidence of public notice of deceased estate.

- In addition to the above, you may be required to supply any of the following below as evidence of death:

- Burial warrant issued by a Local Government Council

- Burial evidence issued by an Islamic Community Head or Judge of a Sharia Court

- Burial evidence issued by a leader of a registered church

- Copy of obituary poster (if any)

A Missing RSA Holder (Presumed Dead)

The employer and/or Next-of-Kin shall notify the PFA of the disappearance of the RSA holder after a minimum period of 12 months. The Next-of-Kin shall provide a satisfactory means of identification which can be any of following:

- Current International passport

- National Identity Card or

- Letter of confirmation of identity from his/her bank or Notary Public.

Upon satisfactory identification of the Next-of-Kin, the PFA shall request for items (i) and (ii) and, if available, item (iii) listed below, which shall serve as adequate evidence that the RSA holder is missing:

- A Police Report confirming that the person has been missing with effect from the reported date, the circumstance of the disappearance and that the person has not been found after more than 12 months.

- Letter of confirmation of disappearance from the employer (if in active employment at the time of disappearance) bearing the passport photograph of the missing person.

- Newspaper publication announcing the disappearance of the person.

Upon completion of sitting, the Board of Enquiry may declare the missing RSA holder as presumed dead. Subsequently, the Beneficiary/Next-of Kin (NOK) will be required to provide documentation for processing the deceased RSA holder’s benefits in line with documentation requirements for accessing the benefits of a deceased RSA holder.

Programmed Withdrawal and Annuity

The Pension Reform act 2014 makes available two broad alternatives when accessing your retirement savings. Please see below the main features of the Programmed Withdrawal and Annuity; the two options to consider when accessing your retirement savings.

| Programmed Withdrawal | Annuity |

|---|---|

| Programmed withdrawal is a product offered to Retirees by Pension Fund Administrators (PFAs). In addition to a calculated lump sum, it provides Retiree a guaranteed income on a monthly or quarterly basis over an expected life span | Annuity Plan is an income replacement product offered to retirees by an Insurance Company. Annuity is a series of payments made to person for life following purchase of the plan. (usually with the proceeds of that person’s Retirement Savings Account under the Pension Reform Act (2014) |

| A retiree may move to Retiree Life Annuity at anytime | Once a Retiree transfers his pensions account to Life Annuity, he/she cannot move back to Programmed Withdrawal. However, he/she can move to another insurance company with the residual value only after two years |

| Retirement benefits is in individual RSA | Retirement benefits is in a pool of annuity fund (belongs to all members on Annuity). |

| The profit on investment is credited into the Retiree’s RSA | Profit on investment is for the insurance company |

| Retiree monthly pension can be reviewed upward based on growth recorded in the RSA from time to time. | There is no increment on the payment assured for life. |

| Retiree receives quarterly RSA statement | Retiree does not receive any RSA statement |

| There is provision of Special Reserves to forestall any shortfall in Retiree Fund | There is no such special reserve for annuity payment |

| Upon demise of a Retiree, the RSA balance with accrued interest shall be paid in full to the legal beneficiaries | Annuity is guaranteed for only 10 years. If the Retiree dies after the guarantee period, beneficiaries are not entitled to the deceased balance in the Annuity pool |

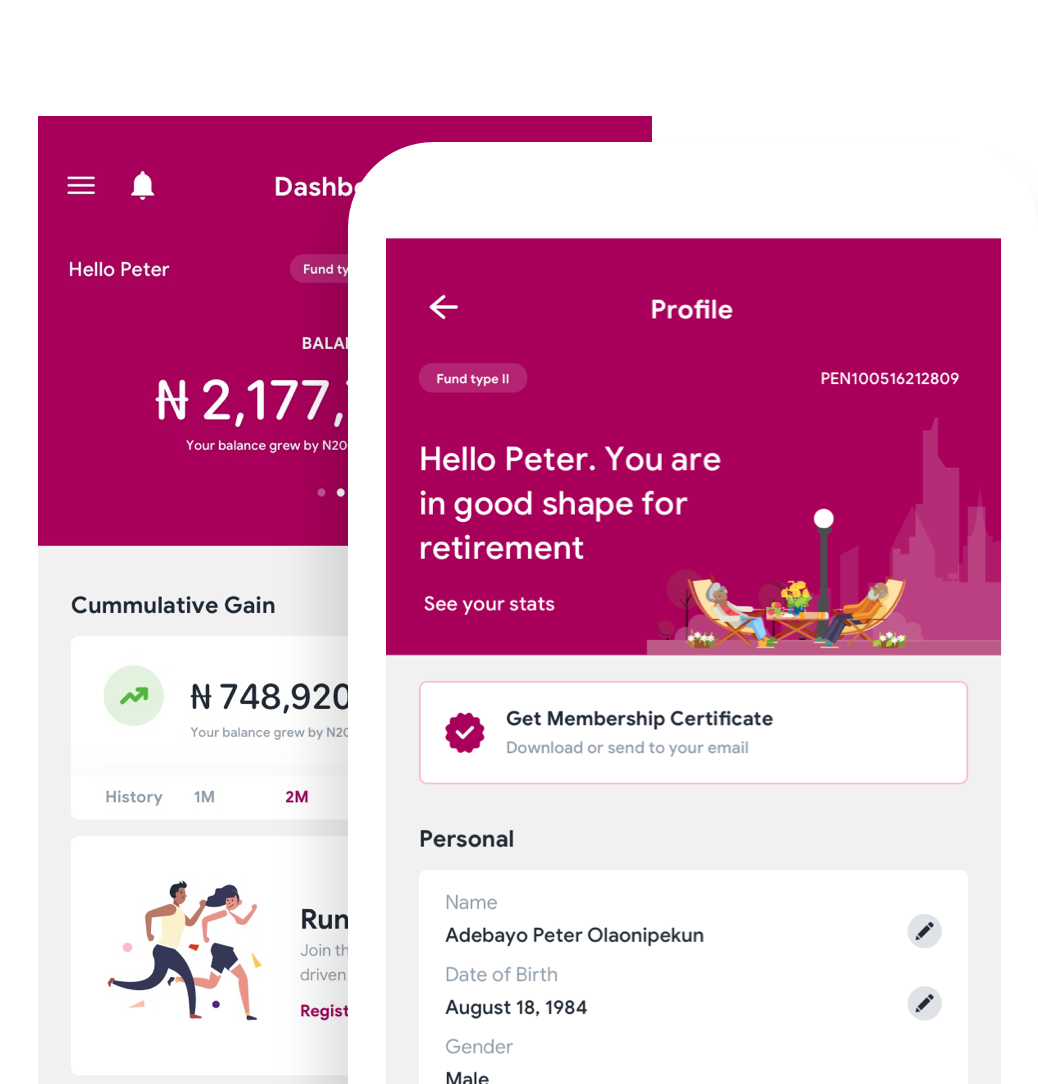

Access your benefits from anywhere

The ‘ARM Engage’ application is an easy to use application from ARM Pension designed to give clients quick access to their Retirement Savings Account information as well as provide useful information to help with retirement planning

Go to portal